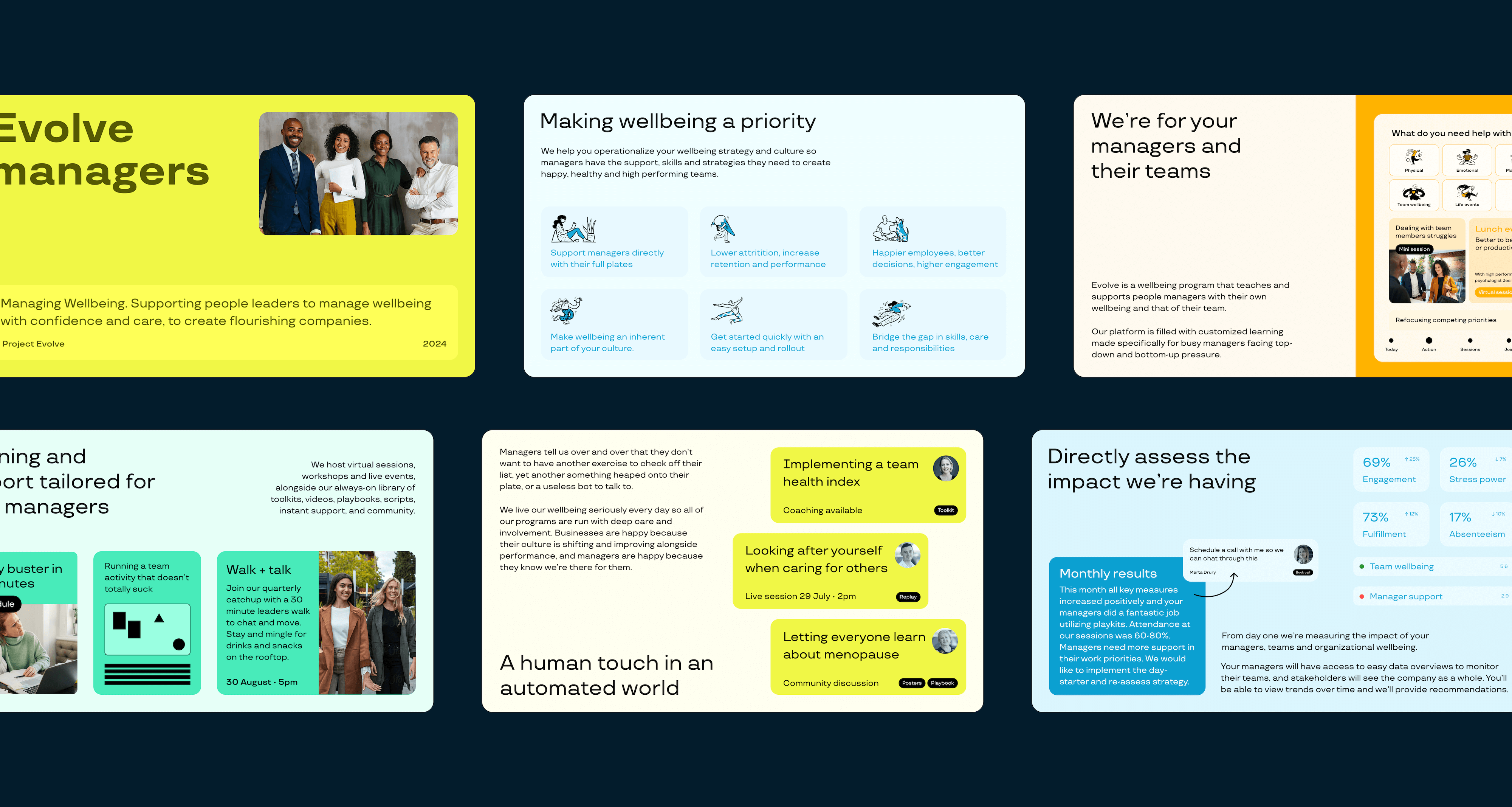

What do you want to work on as a company? What do you believe in?

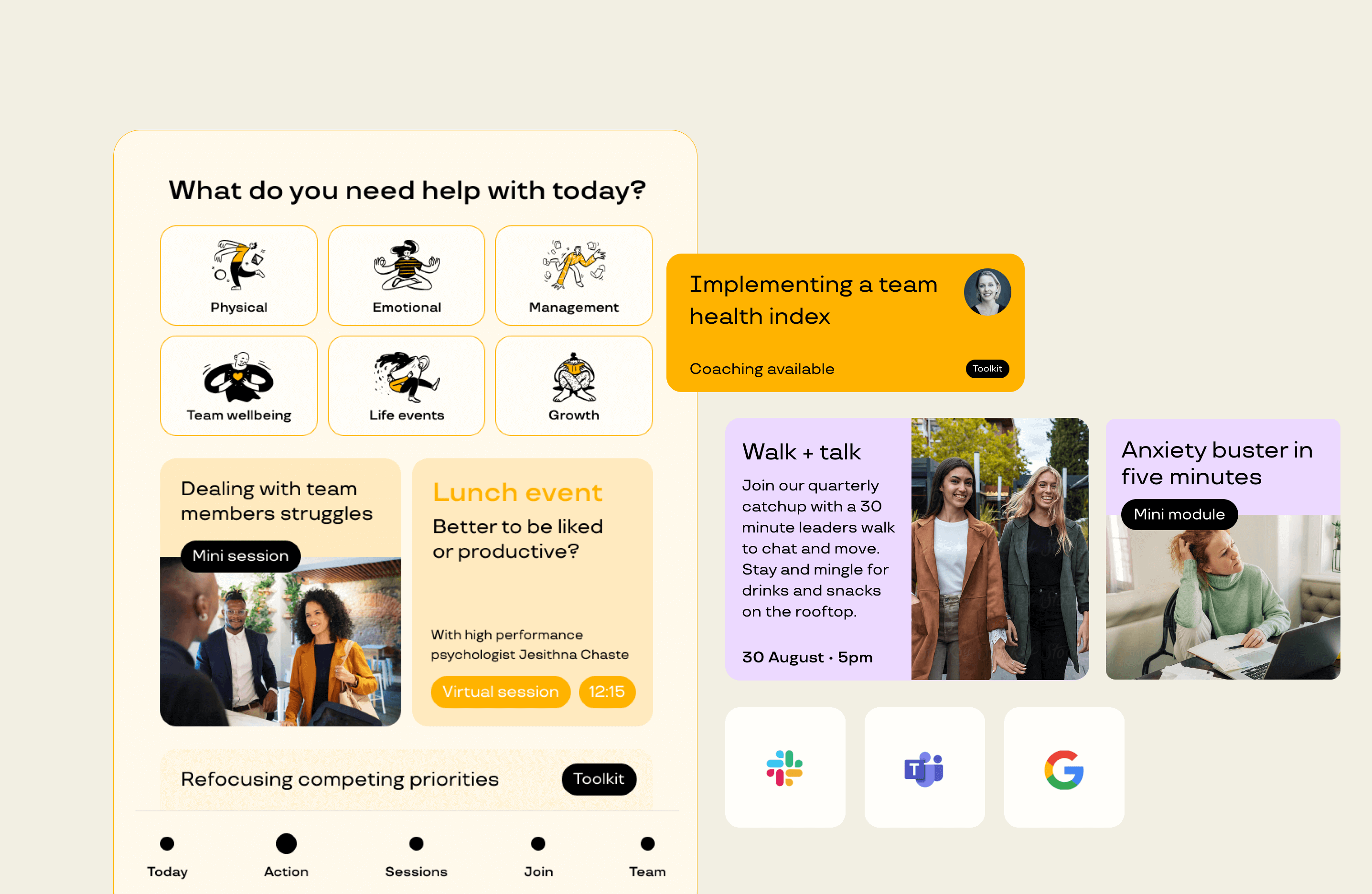

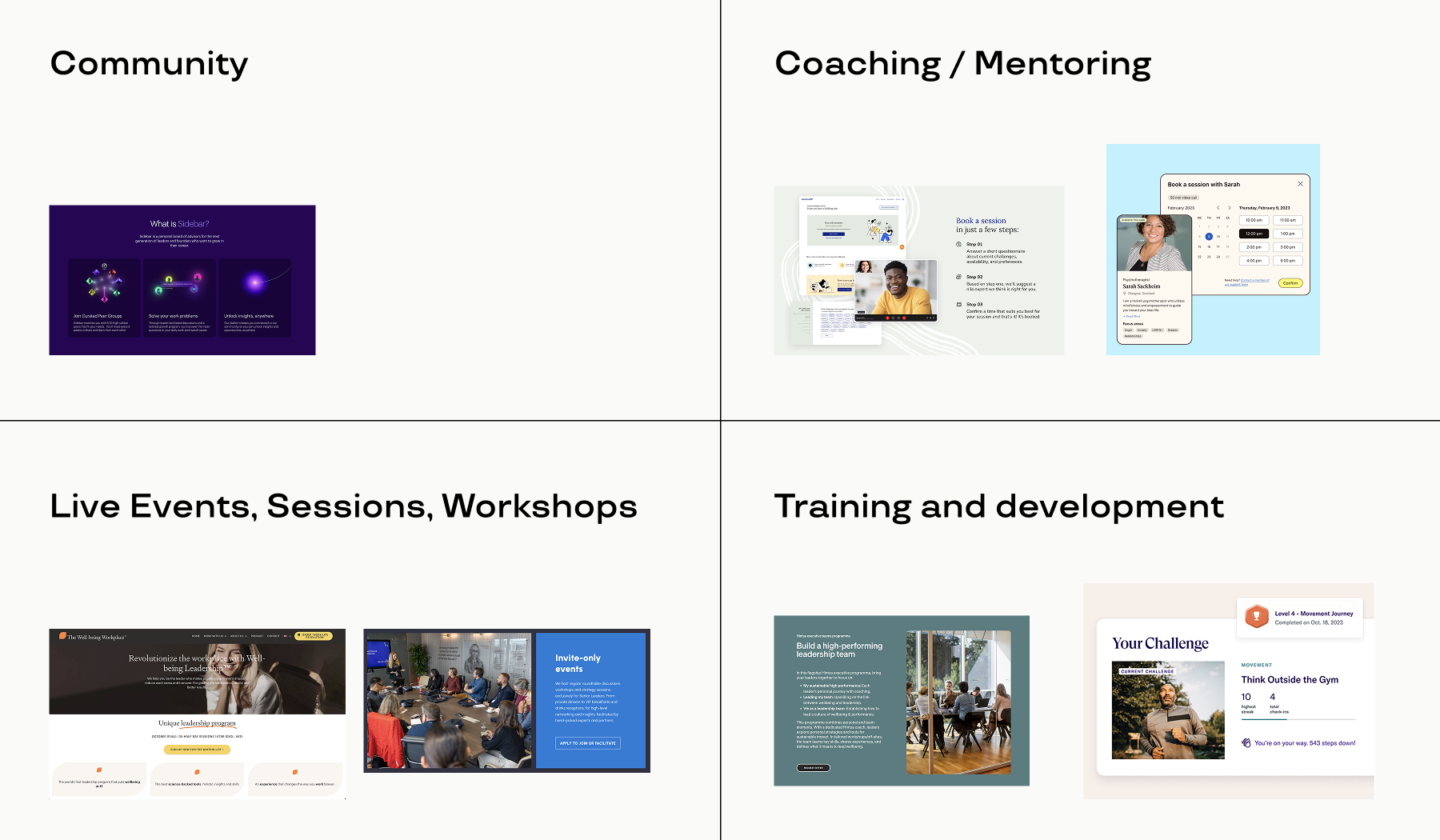

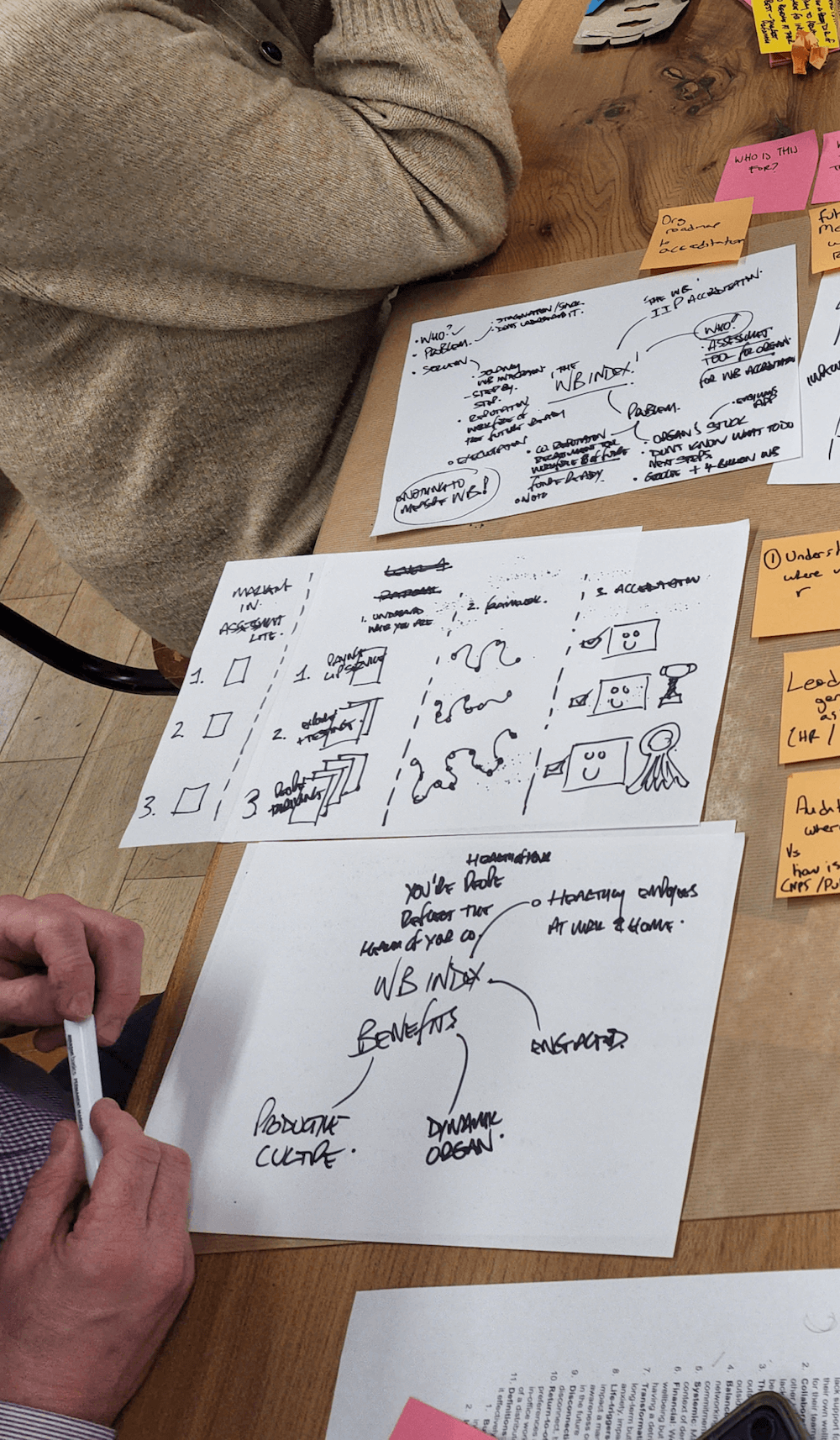

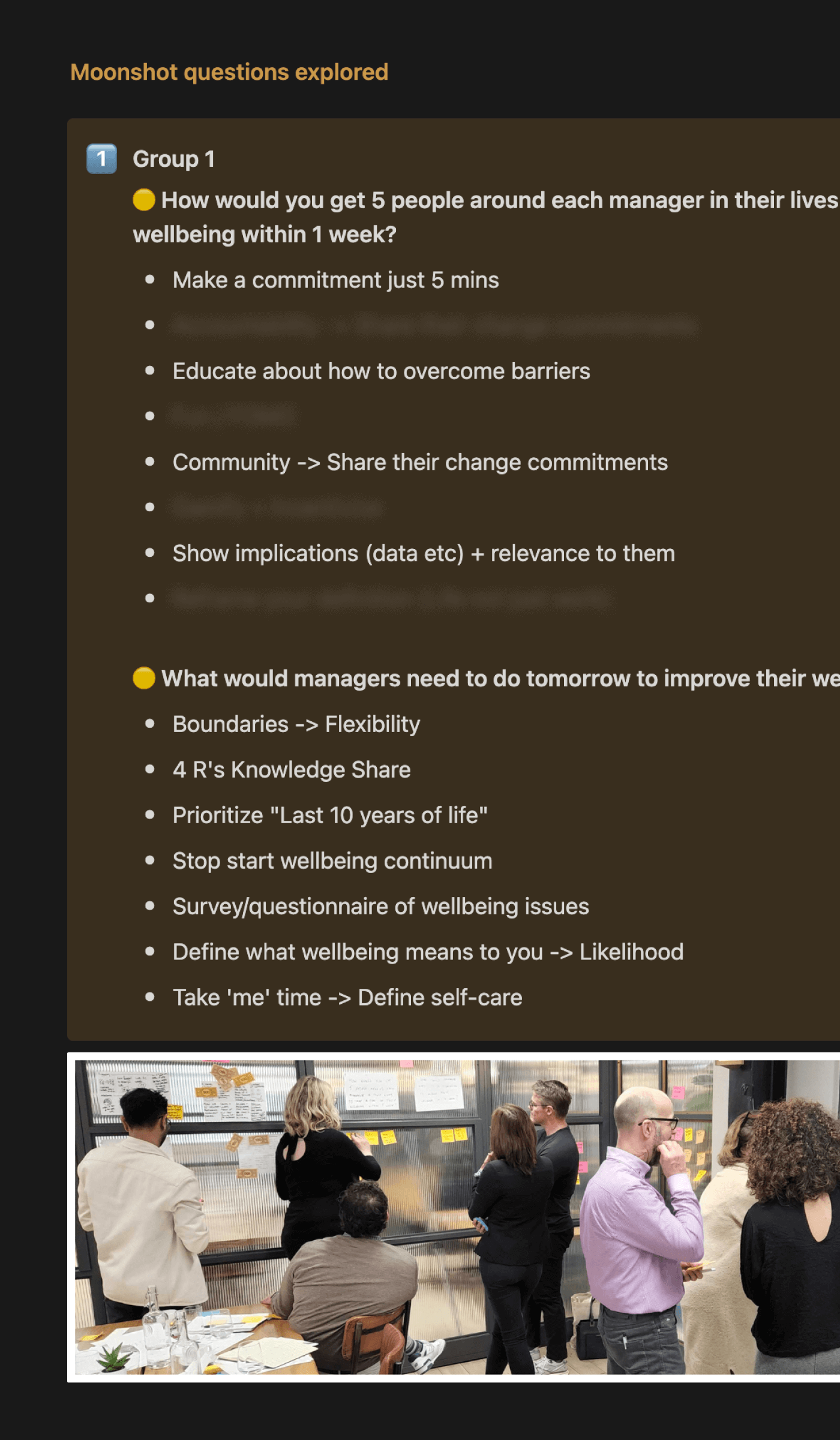

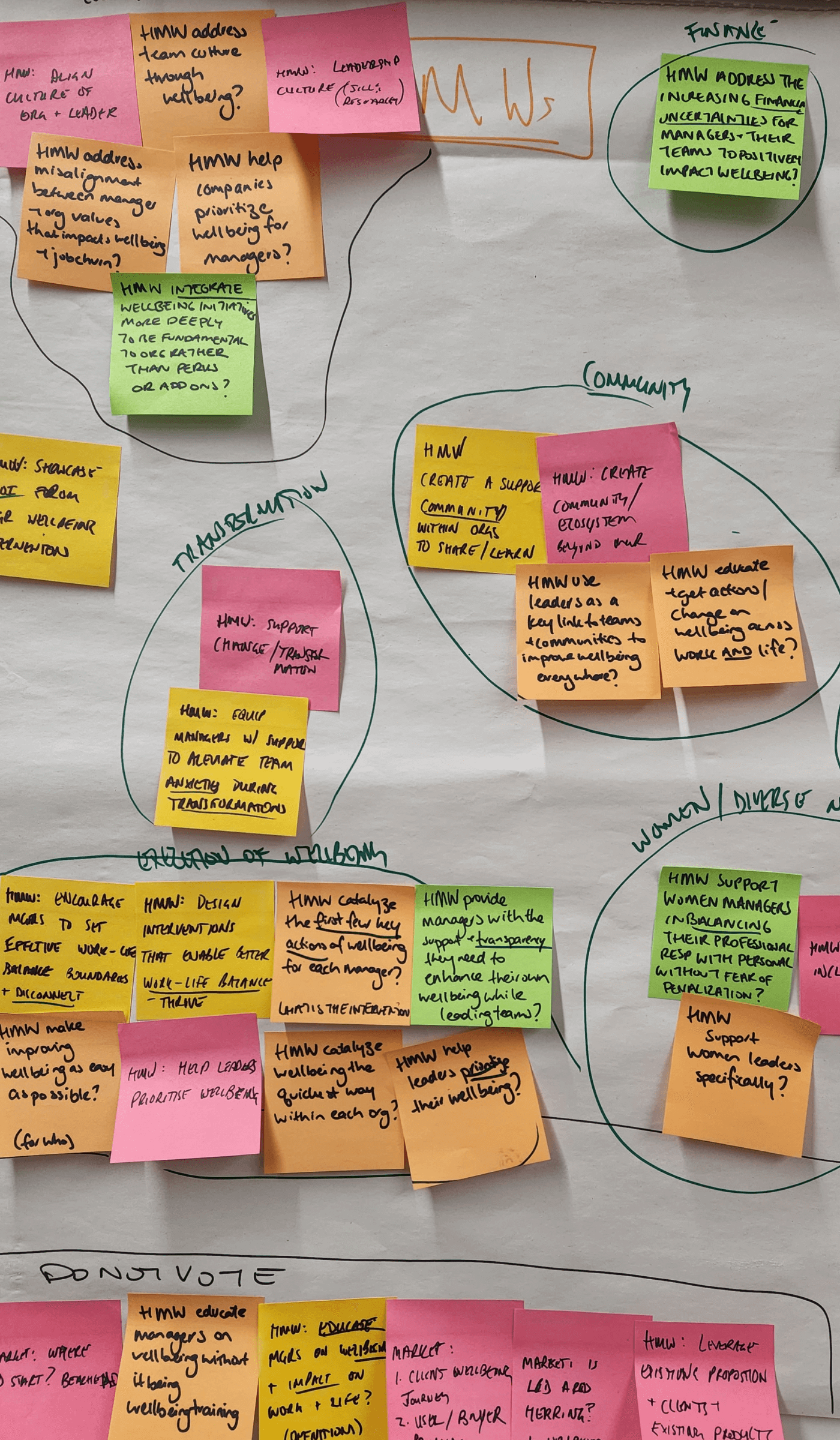

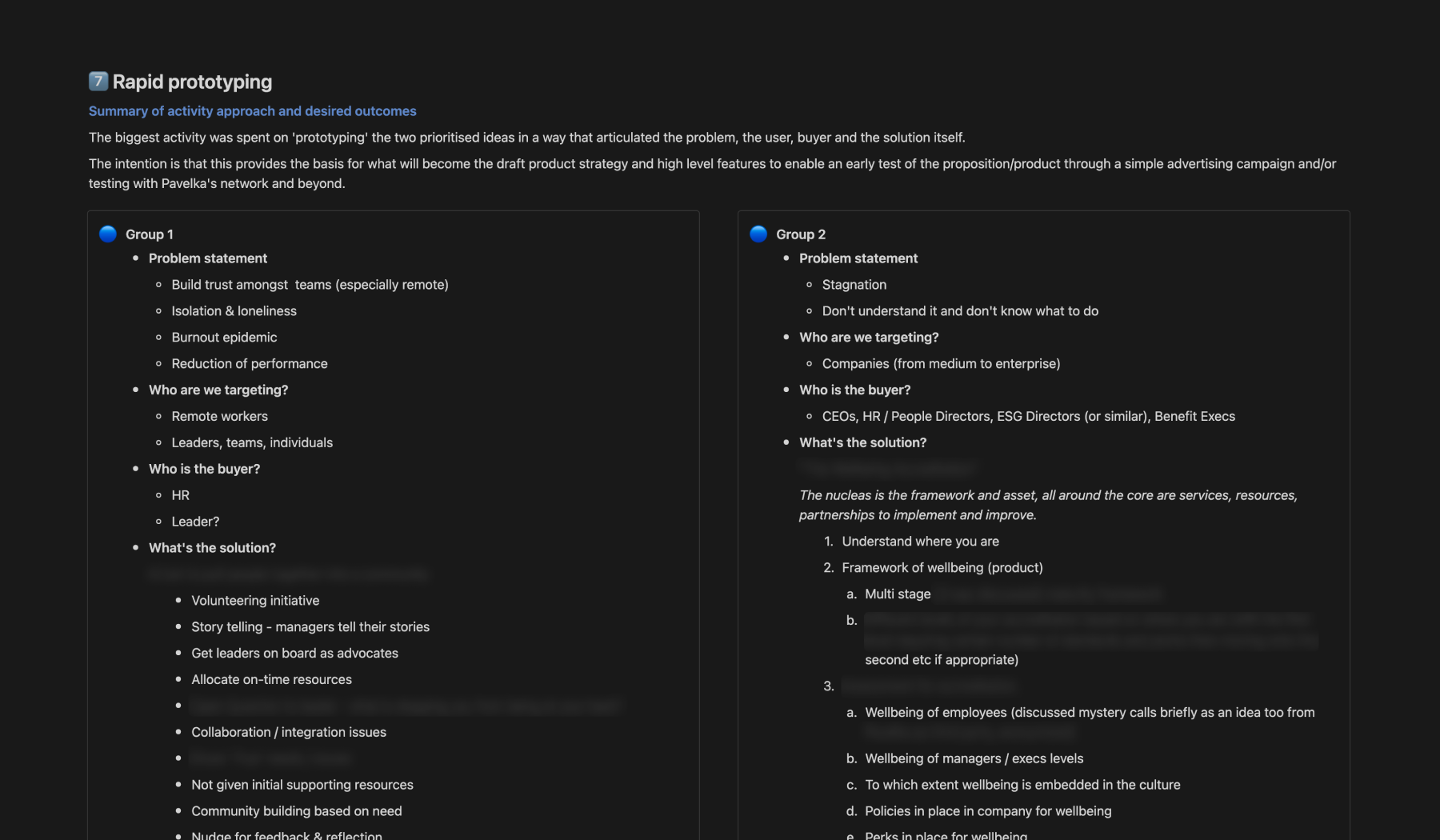

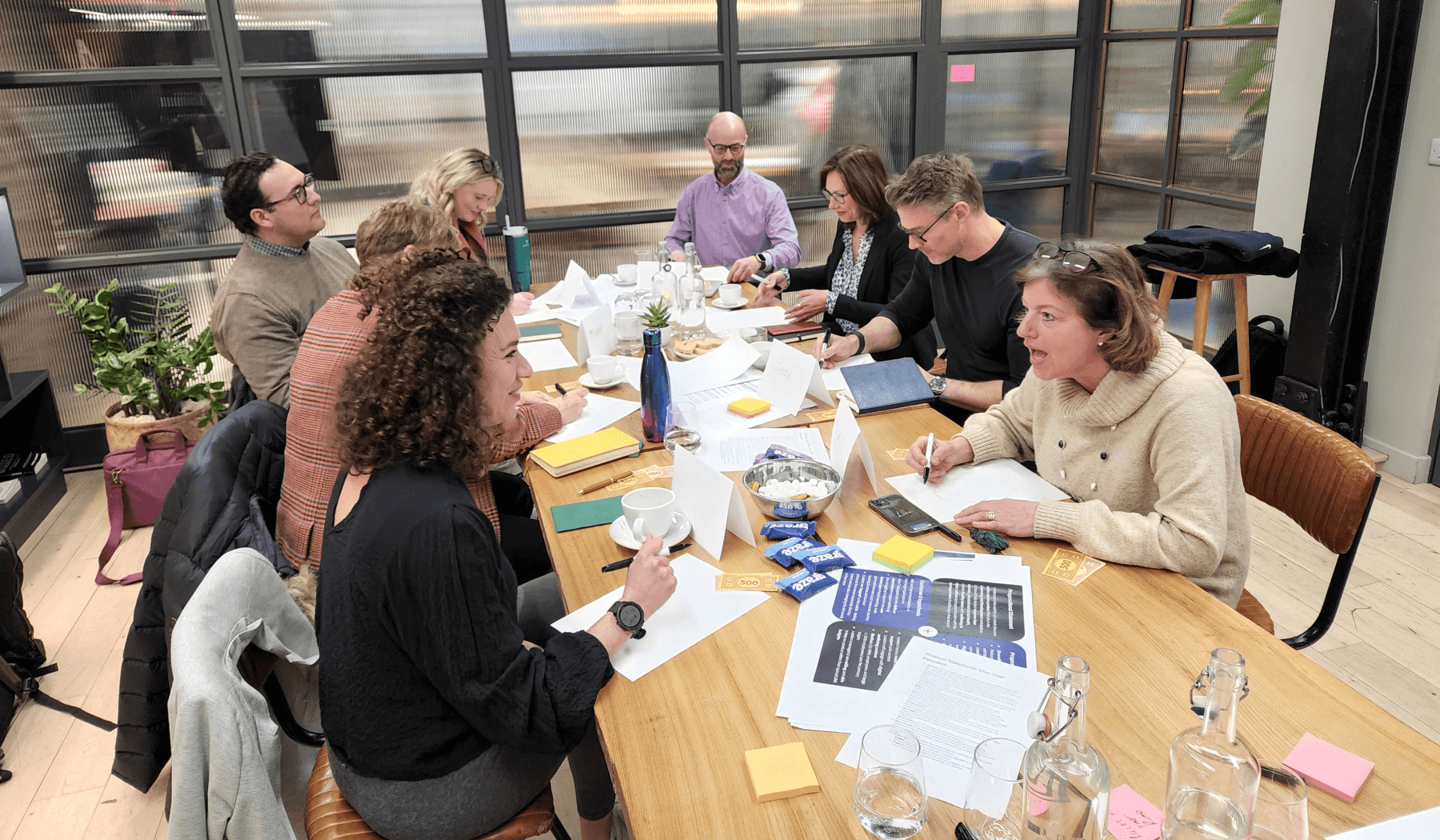

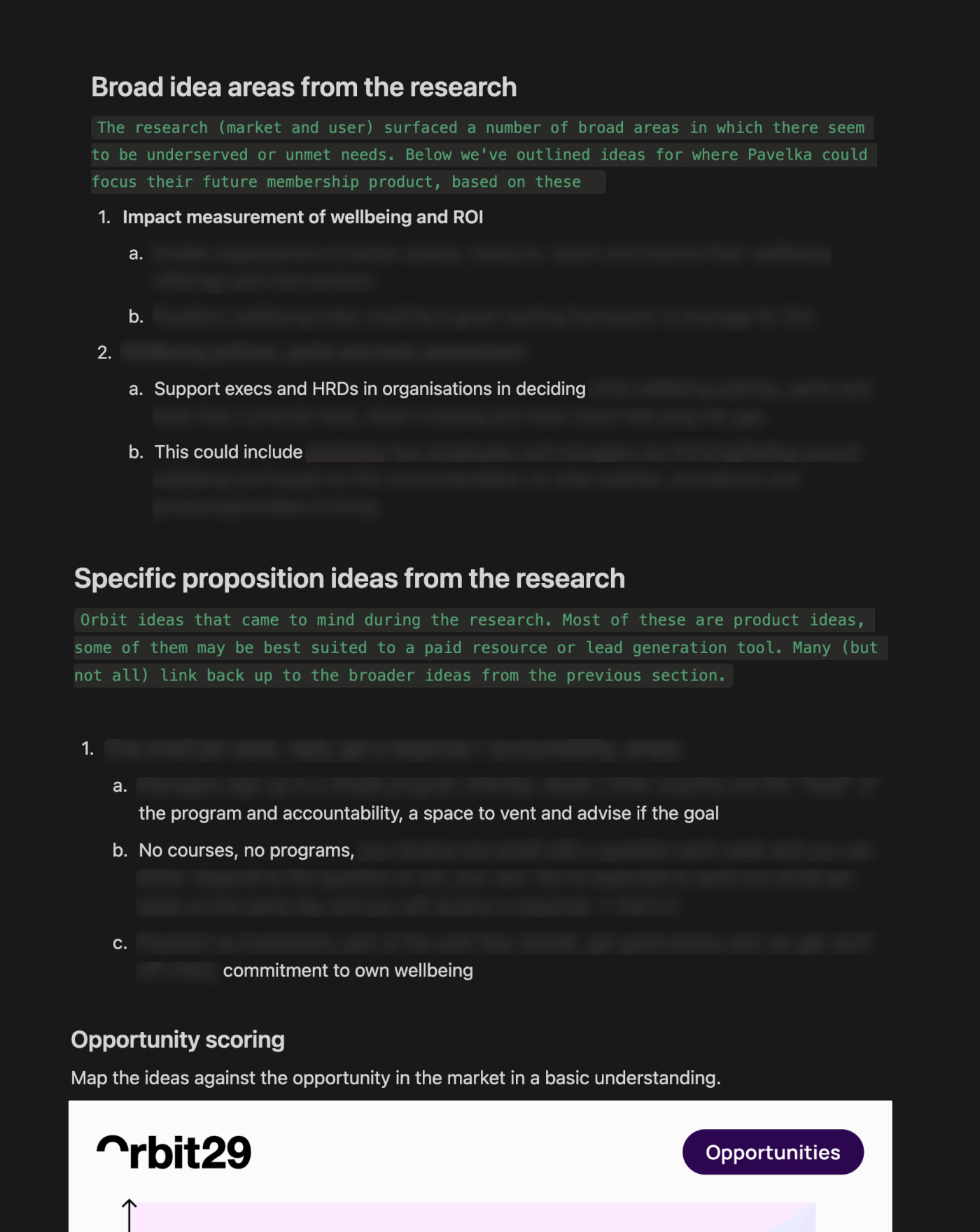

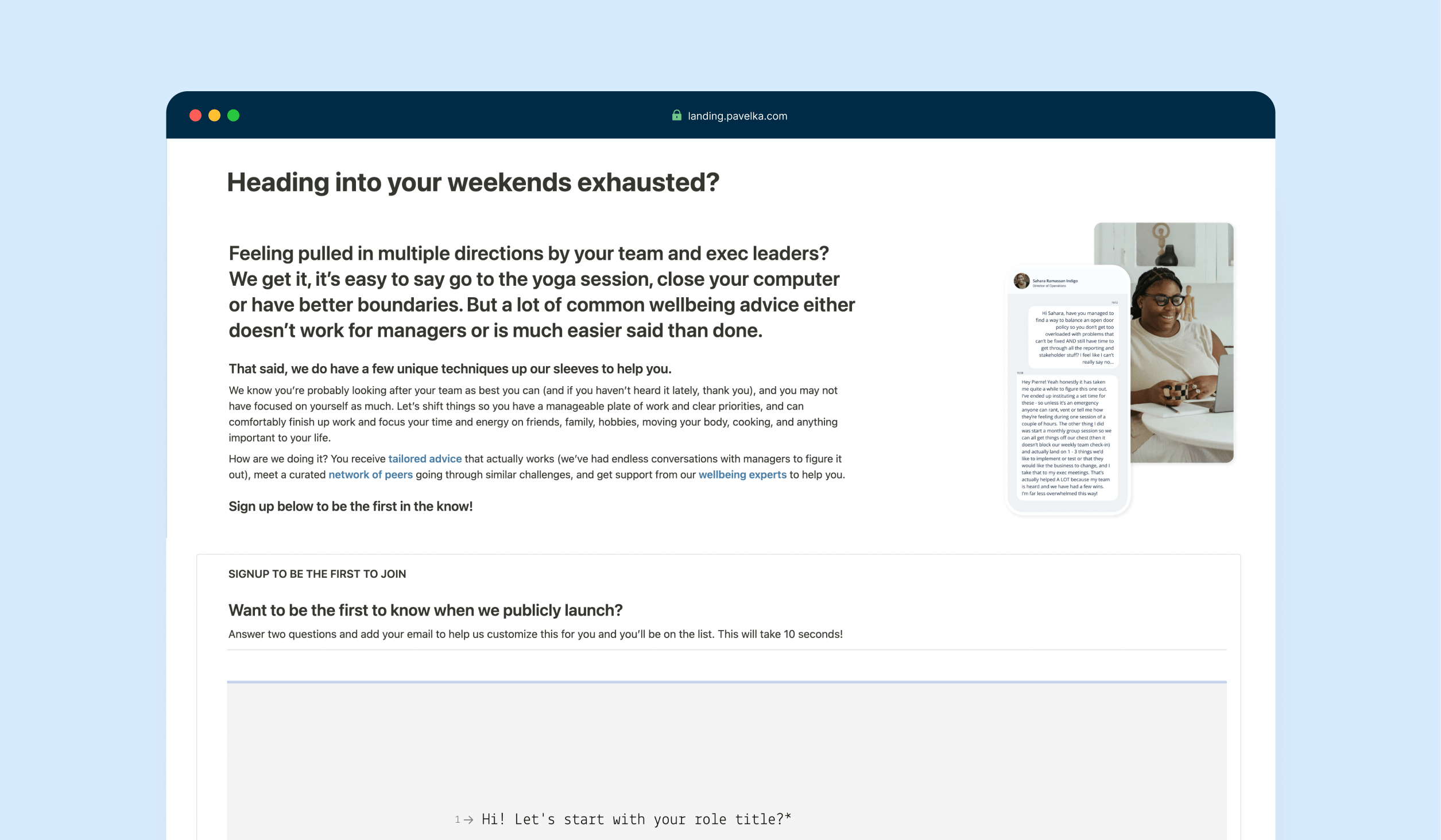

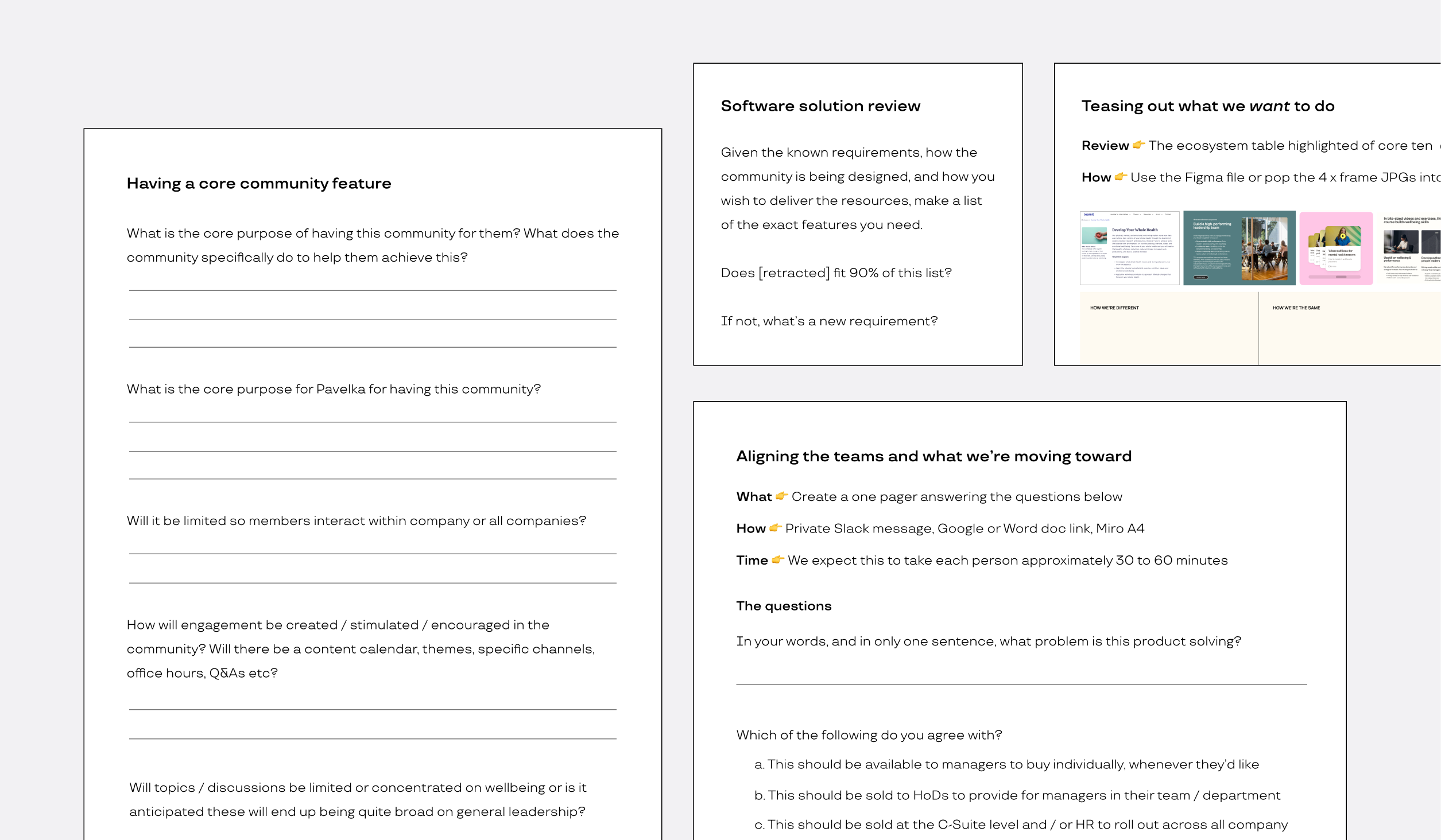

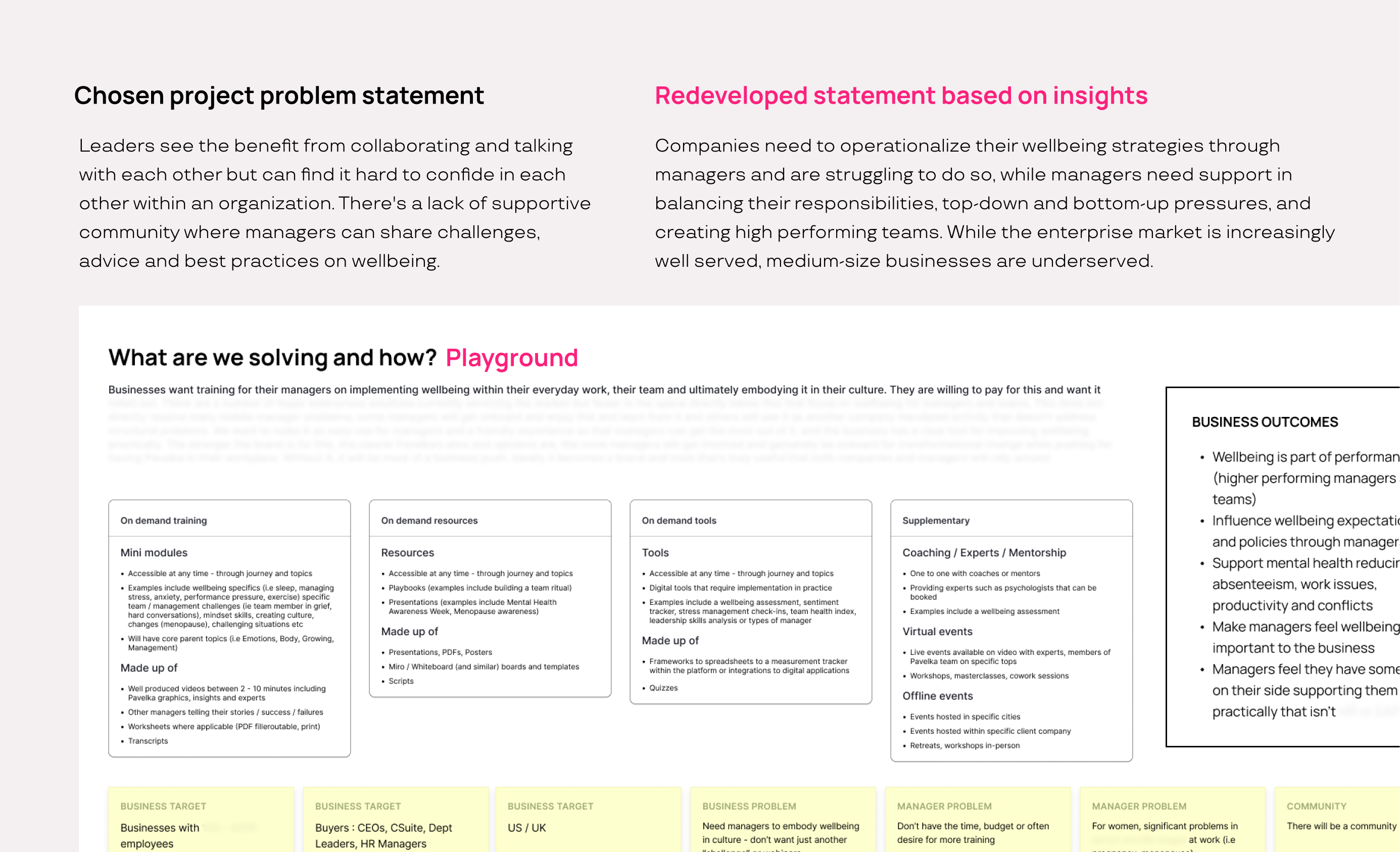

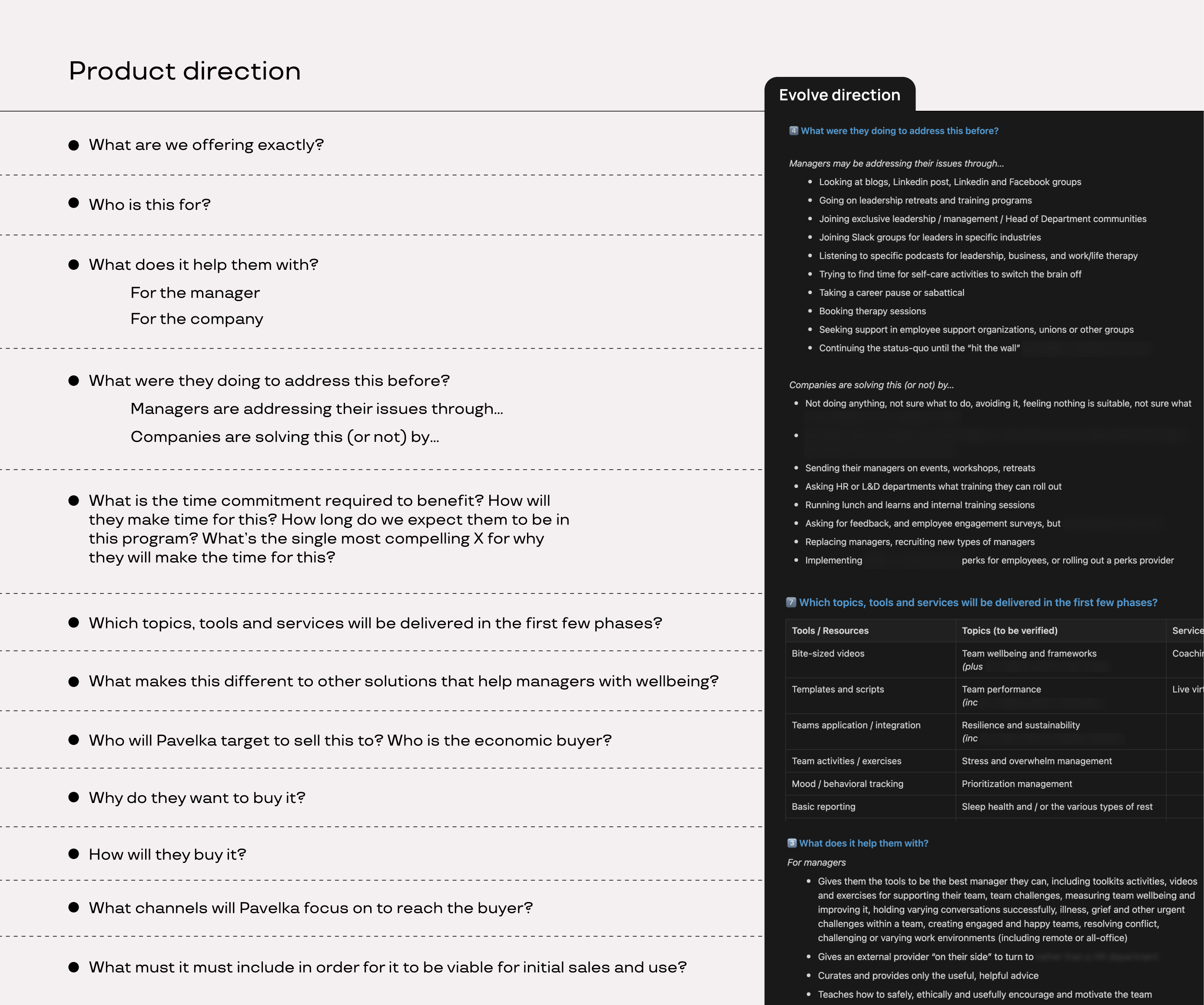

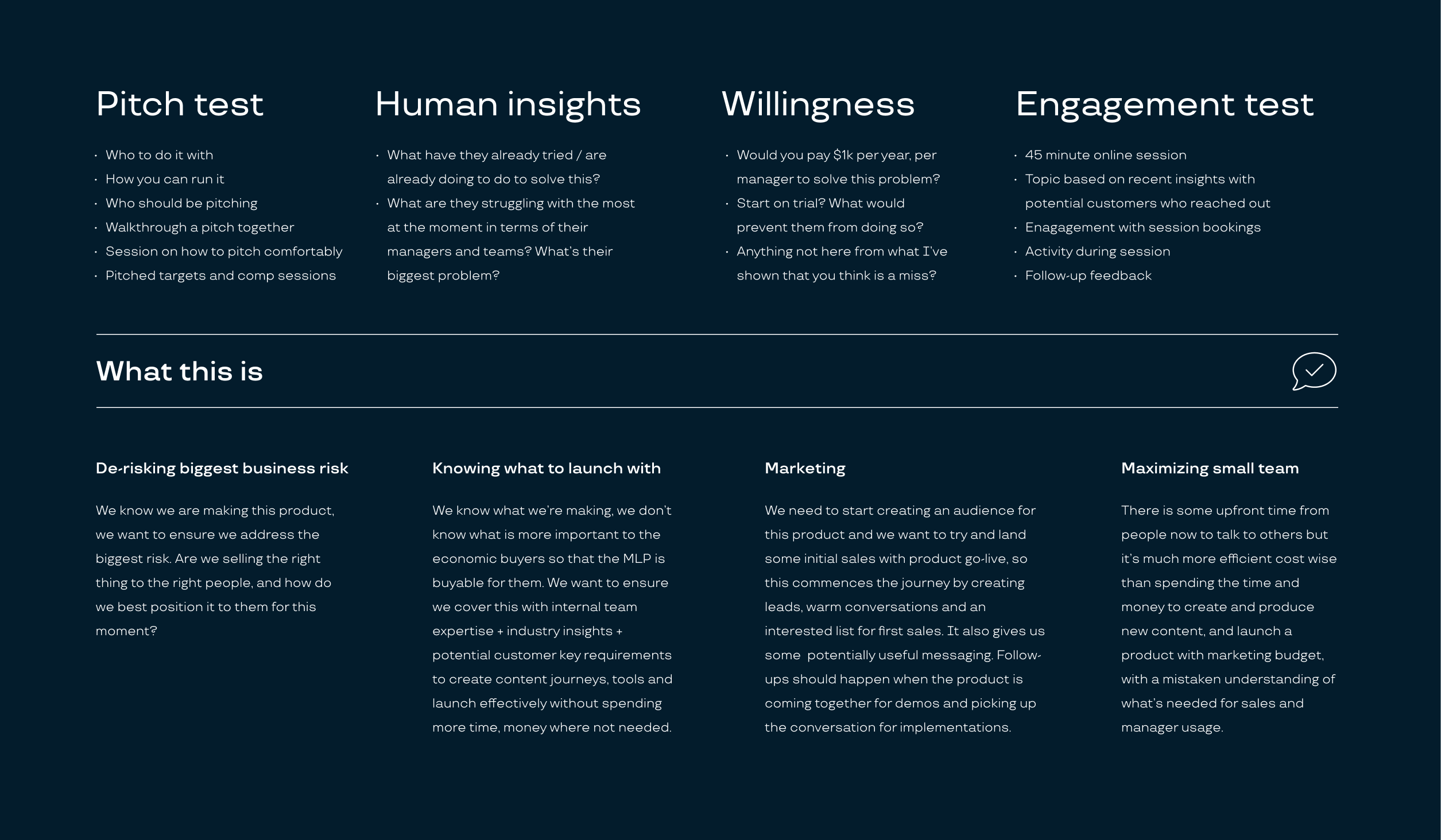

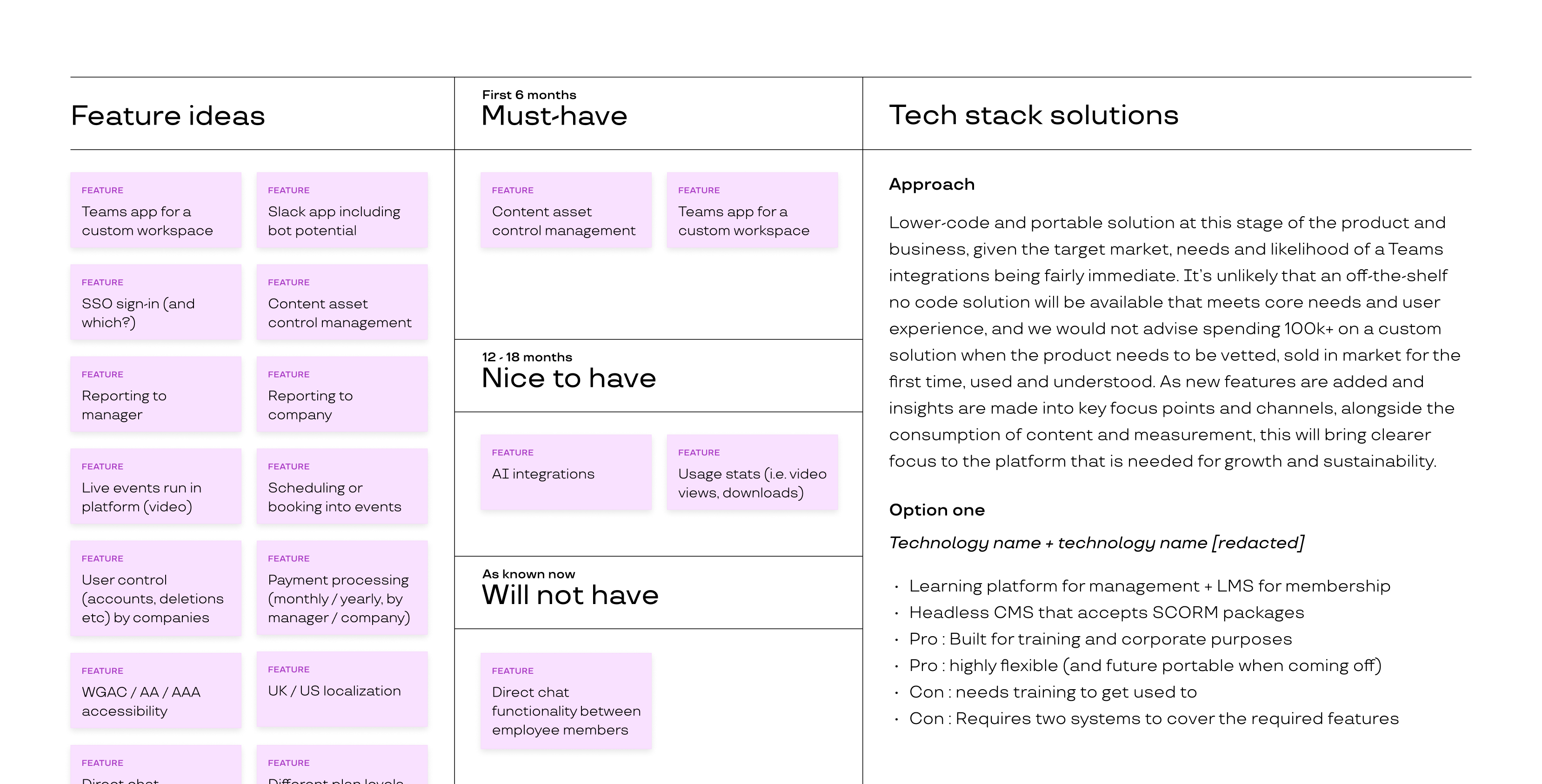

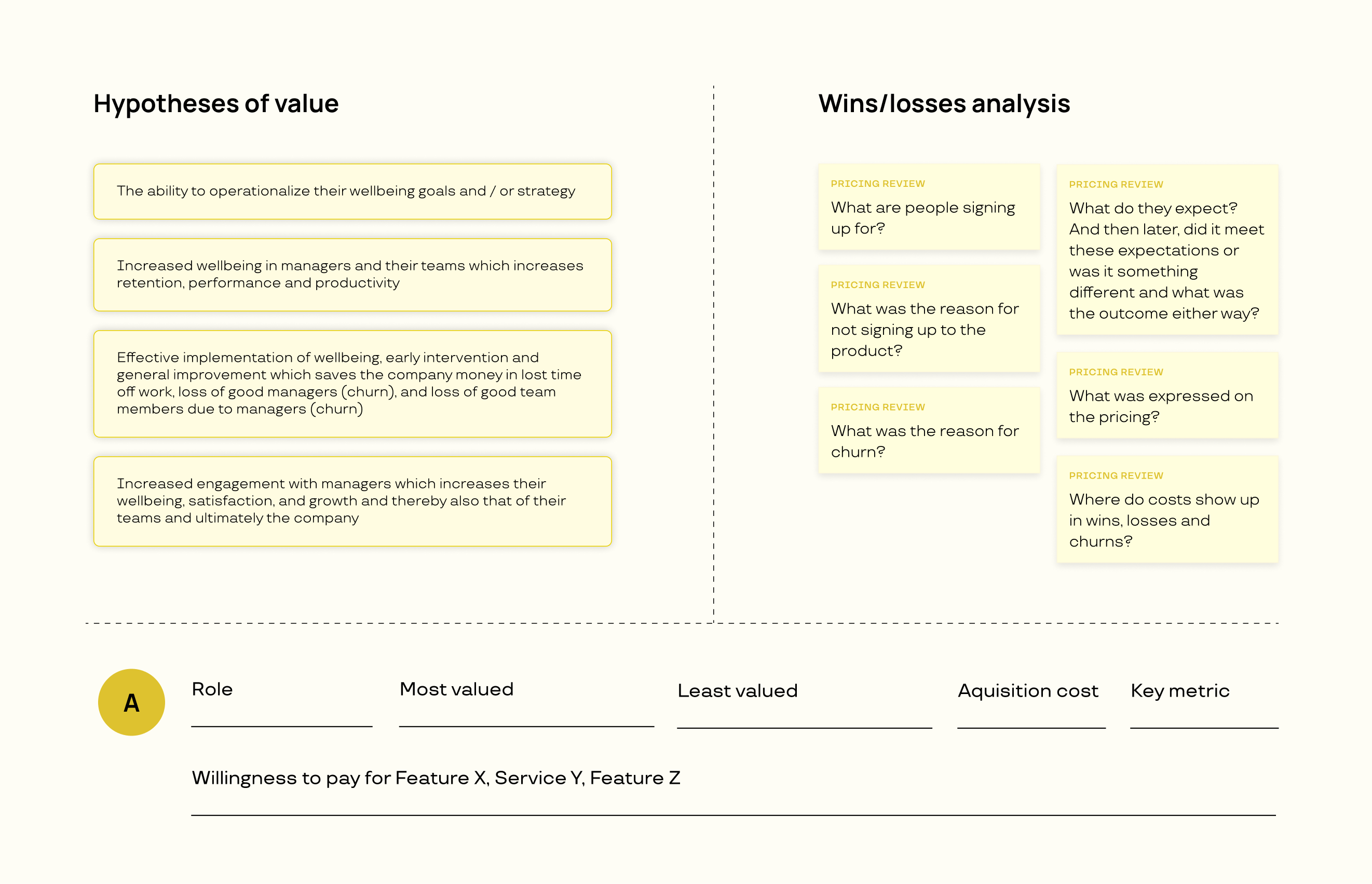

With so many internal ideas and industry problem areas, we had narrowed down a few primary, sustainable pathways that would work for the larger vision, leveraging team knowledge and expertising, and providing a clear path to revenue. The final step was therefore taking everything we had learned and helping Pavelka make the decision on what to move forward with while derisking this as much as possible. Given Pavelka's strong human element, a unique advantage, we wanted to make sure to incorporate this, sustainably. I worked on a async approach giving the team quick activities in succession based on the results of the previous to land on the answer, and create the base of what and how this would practically exist, as it would be all hands-on-deck for the product push. There were also a few ideas floating around that needed support in whether they should exist. These activities helped remove or refine a lot of these, and created more focus.